Venture Capital Private Equity Program

Early Registration Benefit: Invalid liquid data

Invalid liquid data

Understand the Venture Capital (VC) and Private Equity (PE) Landscapes Holistically

The Venture Capital Private Equity Program from Columbia Business School Executive Education will prepare you to succeed in a dynamically transforming investment arena. In this comprehensive program, you will learn how to identify and evaluate what makes a good investment, develop valuation frameworks, structure term sheets, manage portfolios, and learn soft skills such as pitching deals, storytelling with data, and networking. In addition to the core modules, you will engage in a specialized elective that delves into either VC or PE as per your career goals.

What You Will Learn

Venture Capital

Evaluate startups for VC investment and learn to manage a portfolio

Assess a startup's team, market potential, progress, and financial metrics for making informed investments

Learn the intricacies of term sheets, including equity rounds, convertible notes, and governance terms

Explore the various methods and metrics for valuing startups, including risk assessment and understanding capitalization tables

Private Equity

Evaluate what makes a good investment while considering the business environment, price determinants, and exit strategies

Put together a deal, taking into account seller motivations, financing options, regulatory issues, and public vs. private company considerations

Create value in a portfolio company using levers of value, synergies, and pricing

Recognize the contours of success in a leveraged buyout model and other exit alternatives

Live Online Series

The live online sessions will provide you with an opportunity to engage with faculty on core VC and PE concepts and how evolving market trends.

Review an AI Startup

Evaluate how AI innovation, team strength, and market positioning shape startup and venture investment potential.

Spot Emerging Trends

Apply practical frameworks to understand how tech-driven disruption reshapes industries and creates new opportunities.

Rethink Exit and Valuation Strategy

Examine how rapid technological change influences exit timing, valuation, and deal strategy in dynamic markets.

Drive Value with AI

Discover how AI affects value creation, competitive positioning, and regulatory awareness across the private equity landscape.

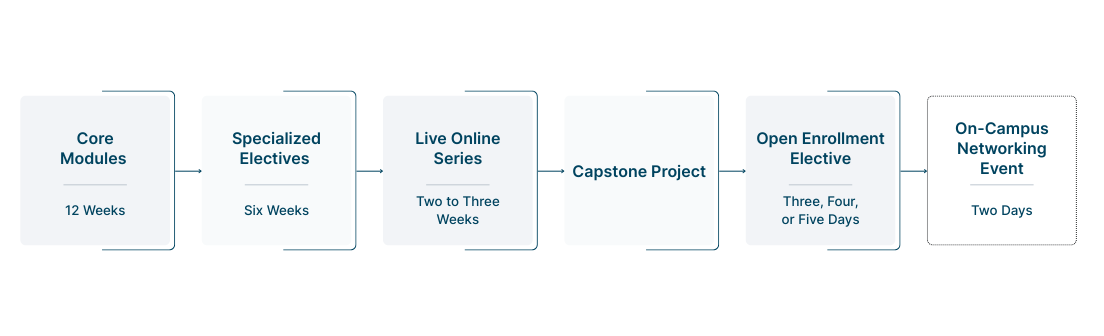

Participant Learning Journey

Program Curriculum

A multimodal learning experience, the Venture Capital Private Equity Program is a must for investment professionals who aim to get a holistic understanding of the VC and PE sectors and become influential contributors to negotiations at their companies. The comprehensive curriculum provides asynchronous learning and live sessions conducted by a learning facilitator and faculty. Participants will also be exposed to a host of engaging online guest lectures and fireside chats with leading industry executives. The flexible format allows for peer-to-peer learning and exploration of “try it” activities as well as practical case studies. The immersive venture capital program culminates in a two-day optional on-campus networking event where you can connect with faculty and global peers.

Foundations of Venture Capital

What Is Venture Capital?

Making sound investment decisions requires knowing the mechanics of VC. By examining key VC components and the role they play in vetting investment opportunities through this venture capital program, you will develop in-depth knowledge of the deal flow process and its risks and rewards.

Understand the VC Deal Flow Process

Recognize the Risks and Rewards for Venture Investors

Identify Startup Ecosystem Stakeholders

Learn How to Source Quality Deal Flow

What Makes a Good VC Investment?

Due diligence is an essential step in VC investing. By imparting guiding principles and key benchmarks, including market sizing and the net promoter score, you will acquire the tools needed to conduct a systematic evaluation of any investment opportunity.

Assess a Founding Team

Pressure-Test Founder Assumptions

Quantify the Size of a Market

Identify Which Metrics Matter Most When Evaluating Startups

What Matters in a Term Sheet?

Term sheets play a critical role in the negotiation process, benefiting both investors and startups. This module looks at the critical points to include when negotiating financial and governance terms, ensuring that your final agreement offers your organization and its investment maximum protection.

Understand Financial and Governance Negotiations

Differentiate between Priced Equity, Convertible Note, and SAFE Round

Calculate Ownership Dilution across the Life of a Startup

Understand Market Norms in Term Sheet Negotiations

How Do You Value a Startup?

Valuing a startup is a complex endeavor. By examining different valuation approaches and how they can be leveraged together, you will acquire a set of best practices for assessing the value of a venture.

Understand Different Valuation Methods and Their Purpose in Assessing Startups

Create a Valuation Scorecard

Quantify and Mitigate Risk

Understand the VC Method

Learn Market Norms around Valuation

How Do You Manage a Portfolio?

Successful VC investing goes beyond making the deal. By looking at the contributions each party must make to manage an investment, you will build a tool kit of practical strategies for maximizing your return on investment (ROI).

Recognize the Role of Investors Post-Investment

Understand Portfolio Construction and Diversification

Calculate the Return of a VC Portfolio

Lessons Learned from 15,000 Pitches

Gaining an edge in the field means translating core concepts into actionable strategies and putting them into practice. This module allows you to learn from actual VC successes and failures, preparing you to make real-world connections and embark on your journey into VC investing.

Hear from Investors about Lessons Learned

Identify Non-Negotiables and Red Flags When Evaluating Startups

Develop a Personal Networking Plan

Launch Your VC Career

Private Equity Investment Cycle

Private Equity Foundations

PE investing has evolved. By examining modern PE investing through this private equity program, you will develop an in-depth understanding of how to navigate the complex PE landscape and identify the factors you must consider when making an investment decision.

Define and Discuss PE and Its History

Examine Net Income and Cash Flow in Relation to PE

Identify PE Stages, Challenges, and Perspectives

Study Related Accounting and Calculations Used in PE Valuations

Research the Business Case for PE

What Makes a Good Private Equity Investment?

Not all deals should be pursued. By exploring the essential elements of a good PE investment and the potential impacts of environmental, social, and governance (ESG), you will gain the expertise you need to identify opportunities with the strongest value potential.

Identify Key Elements and Measures That Make a Good PE Investment

Examine the Impact of Environmental, Social, and Governance in PE

Analyze the Elements and Measures of PE Returns

Review PE Research and Evaluate Findings

Calculate Potential Return Using Standard Deviation

How Do You Put the Deal Together?

PE deals require time and relationship management. This private equity program explores the intricacies of dealmaking, equipping you with the knowledge and skills needed to successfully source and execute a deal.

Identify and Define the Main Components of a PE Deal

Review the Components of PE Deal Sourcing, Time Management, and Relationships

Examine the PE Sales Process

List the Differences between Public and Private PE Organizations

Study the PE Valuation Process, and Perform Related Calculations

How Do You Create Value in Private Equity?

Managed well, portfolio organizations can deliver significant value. Through a thorough examination of price and value fundamentals, you will acquire a set of business strategies you can leverage to maximize your ROI.

Review the Role of Price and Value in a Portfolio Organization

Define Levers of Value in the PE Cycle

Identify Purchase Price Requirements

Define Synergies and Their Relationship to PE

Perform Calculations to Create Positive PE Investment Decisions

What Does Success Look Like?

Success might look a little different in PE investing. Covering the range of possibilities, this module will help you understand the numerous pathways to PE value and success.

Rigorous Investment Thesis: Public and Private Investment

Exit Strategies: IPO Sale to Strategic Buyer, Sale PE Buyer

Pricing Exiting — Elements of Return

Due Diligence Inquiry: Financial, Legal, and Operational

Leveraged Buyout

What Could Possibly Go Wrong?

PE deals carry a greater potential for risk. Through a close examination of risk management best practices, you will develop a set of strategies that will help protect your investment.

The Benefit of Bargain Protections

Risk Management Scenarios

Deal Documentation

Common Merger Agreements

After completing the foundational models in VC and PE, you can choose between two comprehensive specialized electives, each meticulously crafted for VC and PE, respectively. These electives delve deeper, presenting you with critical insights that go beyond the basics.

VC Decision Making: This elective will help you learn how to create a successful investment strategy to improve venture fund performance. You will establish your individual investment criteria and intelligently diversify your portfolio.

or

Leveraged Buyouts: This elective will help you build a comprehensive understanding of leveraged buyouts (LBO) and the process of completing them. You will learn how to evaluate a potential LBO opportunity in PE and effectively execute the deal.

Note: Session topics are subject to change.

You will take part in mandatory live online series led by Columbia Business School faculty, applying learnings from core modules. These sessions will improve and expand your understanding of venture capital funding strategies and help you better assess various industries and startups for their economic potential. Apart from gaining a strategic eye, they will also inform you about the latest regulatory landscape in private equity.

Evaluating a Startup

Assessing an Industry

Navigating an Exit

Understanding the Private Equity Valuation Creation Levers: The LBO Model and Beyond

The Eyes of a Strategic

Say It Ain't So: The Evolving Regulatory Landscape Facing Private Equity

Note: Live online series topics are subject to change.

Venture Capital Capstone

In the VC capstone project, you will assess the investment potential of two organizations that participated in an Entrepreneur Roundtable Accelerator Online Demo Day, a showcase where investors can learn more about investment opportunities. You will watch pitches for each organization. Then, applying your learnings from the program, you will answer a series of diligence questions to evaluate each option. Your answers will serve as the basis for a diligence summary that you will submit for faculty feedback. Challenges addressed in this capstone include identifying risks and rewards and performing thorough diligence encompassing people, problems, progress, and price.

Private Equity Capstone

In the PE capstone project, you will select an organization and evaluate its investment potential, focusing on the sourcing and due diligence steps of the deal process. Applying what you have learned, you will answer a series of questions to identify, define, and analyze the components needed to complete a PE transaction. Your answers will serve as the basis for a diligence summary that you will submit for faculty feedback. Challenges addressed in this capstone include recognizing a sound investment, measuring ESG, valuing a potential investment, determining the purchase price, and developing an exit strategy.

A choice of one in-person open-enrollment elective offered in three locations — New York City, Dubai, and Paris will enable you to focus on a specialization of your interest and help unravel the intricacies of your selected topic. Designed to enhance your understanding of the VC and PE sectors, it will help position you as a serious investment strategist aiming to take your organization to newer heights. A list of select current availabilities is below:

Driving Strategic Impact

Financial Analysis and Valuation

Leading in a Data-Driven World: Developing Quantitative Intuition™

Persuasion Strategies

Real Estate Investing

Note: While Columbia Business School Executive Education will attempt to accommodate participant preference selections, we cannot guarantee that all preferences will be granted due to the high demand for our open-enrollment programs. Electives are subject to change.

Meet your cohort peers and faculty in person on Columbia Business School’s Manhattanville Campus in New York City during an optional two-day networking event. This event provides you with an opportunity to network with your peers as well as professionals from other cohorts to create a lifelong community of global executives.

Note: Session topics and networking event duration are subject to change.

Live Online Series with the Faculty

You will take part in mandatory live online sessions led by Columbia Business School faculty. These interactive sessions build on the core modules and help you apply theory to real-world scenarios. You will deepen your understanding of venture capital funding strategies, sharpen your ability to assess industries and startups for economic potential, and gain insights into how AI and technological transformation are reshaping value creation and market dynamics. The sessions also address the evolving regulatory landscape in private equity. Through these sessions, you will uncover insights on:

Evaluating an AI Startup

Assessing an Evolving Industry

Navigating an Exit: Adapting Strategy amid Rapid Innovation

Harnessing AI to Unlock Private Equity Value Creation Levers

Eyes of a Strategic Buyer in the Age of AI

Understanding the Technology-Driven Regulatory Environment in Private Equity

Meet the Faculty

Senior Lecturer of Finance, Private Equity Program Co-Director, Columbia Business School

Professor of Professional Practice, Finance Division, Columbia Business School

Certificate in Business Excellence

Upon completion of the Venture Capital Private Equity Program, participants are awarded the Certificate in Business Excellence from Columbia Business School Executive Education. The certificate is a recognition of their achievement and the investment they and their organization have made in their education and development.

As a Certificate in Business Excellence holder, you will receive a 25 percent tuition benefit for full-price Executive Education in-person programs lasting three and four days and all full-price online programs. Exclusions apply

Certificate holders will also be awarded select Columbia Business School Alumni benefits.

Your digitally verified certificate will be issued in your legal name and emailed to you, at no additional cost, upon completion of the program, including all modules of the program (online, in person, or live online, inter-module). All certificate images are for illustrative purposes only and may be subject to change at the discretion of Columbia Business School Executive Education.

CIBE Holder Benefits

As a Certificate in Business Excellence holder upon completion of this program, you will be awarded select Columbia Business School alumni benefits.

Access to Columbia Business School Alumni Career Services resources, including unique career content, a job board, an online networking platform, the alumni directory, and more

Invitations to alumni events and programs around the world

Eligibility to join Columbia Business School alumni clubs

Global networking opportunities

Lifetime Columbia Business School forwarding email address

Subscription to our alumni publication Columbia Business

Your digitally verified certificate will be issued in your legal name and emailed to you, at no additional cost, upon completion of the program, including all modules of the program (online, in person, or live online, inter-module). All certificate images are for illustrative purposes only and may be subject to change at the discretion of Columbia Business School Executive Education.

Hear from Our Participants

"The program has been instrumental in sharpening my abilities to evaluate investment opportunities and giving me tremendous framework of tools that I can use every day."

— Yannis Apostolopoulos, CEO, Specialty Coffee Association

Venture Partner at Expert Dojo

"Finding an opportunity in VC is not easy with the current market conditions. As someone who came from an operator/founder background, the Venture Capital Private Equity Progr...

Angel Investor

"The two-day networking event covered a wide array of topics imparting insights from thought leaders on US and global economic conditions, learning to think bigger, innovation...

Founder and CEO of Syndicate Venture Group

"Participating in this program was a transformative experience for my career, providing me with crucial insights and in-depth knowledge that were instrumental in founding my o...

Venture Capital & Startup Advisor

"I liked the simplistic nature of how the content was introduced and explained, making it easy to understand and applicable to my career."

Startup CEO and Fund Manager

"The instructors were the best part because they effectively communicated the content, shared real-world insights, and juxtaposed theoretical concepts with industry trends."

Climate Change Policy Specialist

What I really liked about the program were the faculty, Angela Lee and Donna Hitscherich, the accessibility and user-friendliness of the Canvas platform, the well-designed mod...

Attorney

"The sessions were delivered using extremely practical examples, life scenarios, and resources that made the experience immersive."

Global People & Talent Leader

"Donna Hitscherich is a very effective instructor. Her teaching was clear and engaging, and she kept building context from session to session."

Global People & Talent Leader

"I liked the PE capstone project. It was a great opportunity to apply concepts learned in the program and learn from the feedback provided by the success coach, Michael Hillme...

Who Is It For?

The Venture Capital Private Equity Program is ideal for mid-level to senior professionals, including:

Finance and consulting professionals looking to build a deeper understanding of the VC and PE landscape and broaden their exposure across asset classes

Non-finance professionals from sectors such as general management, real estate, healthcare, telecom, technology, and IT looking to expand their footprint into VC and PE investing

Professionals with existing experience in VC or PE who are looking to broaden their investment horizons and deepen their strategic perspectives

Participants should have:

Fluency in written and spoken English

FAQs

The Venture Capital Private Equity Program is a comprehensive 9- to 12-month program offered by Columbia Business School Executive Education, designed to prepare professionals like you for success in venture capital and private equity.

This private equity program provides essential skills, knowledge, and networking opportunities that can significantly enhance your prospects of entering the private equity field. It helps you discover deal evaluation, portfolio management, and value creation strategies.

Yes, the venture capital program covers crucial aspects of venture capital, including startup evaluation, term sheet structuring, and portfolio management, which are essential for those aspiring to become venture capitalists.

Yes, the program includes specialized electives that allow you to dive deeper into either venture capital or private equity, depending on your career goals.

The program includes peer learning with high-achieving professionals from around the globe and an optional two-day on-campus networking event, helping you build valuable connections in the private equity industry.

While the program does not specifically focus on how to start a venture capital firm or starting a private equity firm, it does provide in-depth knowledge of venture capital operations, decision-making processes, and industry best practices, which are crucial for those considering launching their own venture capital firms.

Yes, the program includes financial analysis and valuation modules that cover essential aspects of private equity accounting and financial management.

The Venture Capital and Private Equity Program spans 9 to 12 months, allowing for a comprehensive learning experience while accommodating working professionals.

Yes, the Venture Capital and Private Equity Program includes a capstone project that allows you to apply your learnings to a real-world case, demonstrating your ability to tackle complex investment scenarios.

The Venture Capital Private Equity Program has been designed with your busy schedule in mind. You will be required to commit no more than three to five hours per week, enabling you to benefit from this transformative program while fulfilling your day-to-day work responsibilities. The impactful program offers a blend of self-paced modules and live interactions.

The 9- to 12-month learning journey includes live online and video online sessions with renowned faculty, industry experts, and global peers. You can take advantage of weekly live sessions and the Slack channel to ask questions and discuss ideas with your cohort participants. Real-world examples and a debrief of the program learnings are delivered through a combination of recorded video and live online lectures. The program concludes with an optional two-day on-campus networking event on the Columbia Business School campus in New York City.

The program fee covers teaching fees, all academic material, and access to online coursework. The fee does not include accommodations for the two-day in-person networking event, travel expenses (domestic, international, visa fee, and more), and other expenses not specifically mentioned in the fees.

You can pay the full program fee up front or pay in easy installments. If you apply well in advance of the program start date, you can receive a fee benefit. If you would like to approach your company with a sponsorship request for this program, here is a customizable template that you can use.

Yes. Closed-captioning and transcripts for all pre-recorded videos as well as closed-captioning for recordings of live sessions is available.

Emeritus collects all program payments, provides learner enrollment and program support, and manages learning platform services.

For the program refund and deferral policy, please click the link here.

Program fees for Emeritus programs with Columbia Business School Executive Education may not be paid for with Title IV financial aid funds. Participants may be able to pay the program fee with funds from the GI Bill, the Post-9/11 Educational Assistance Act of 2008, or similar types of military education funding benefits. Participants must contact the Columbia University’s Office of Military and Veterans Affairs to determine benefit eligibility.

An email forwarding address is not an inbox and does not store or send messages. Users cannot log in to a forwarding address to view messages as it does not have its own mailbox. Instead, it functions solely to redirect incoming emails to another active email account.

(e.g.)

Email forwarding address: janedoe@gsb.columbia.edu

Target address: janedoe@gmail.com

Questions? Connect with a Program Advisor

Email: columbia_vcpe@emeritus.org

Phone: +1 567 587 1669 (U.S.) / +44 1156 471398 (U.K.) / +971 80 0035703759 (U.A.E.) / +52 55966 08595 (LATAM)

Early applications are encouraged. Admissions are reviewed on a first-come, first-served basis.

Flexible payment options available.

Starts On